The global chip shortage is behind all kinds of woes for the synthesizer and drum machine market, from release date delays to bankruptcies. We find out exactly what’s behind the shortage, who it’s affecting and how long it will last.

It happens all the time now. An exciting new piece of hardware is advertised. There’s a media blitz, with tightly coordinated exposure of news and reviews in print, online and across YouTube. Interest is at a fever pitch, with punters yelling, “Shut up and take my money” across Facebook and Reddit. And then… nothing. No more is heard about the product for ages until it quietly shows up on Thomann and Sweetwater months after the original announcement.

Why the long delays? Why are companies teasing new products only to seemingly never release them? And why are small boutique outfits discontinuing popular items and even going out of business? The answer to all of these questions is the chip shortage, a phenomenon that is much more complex and byzantine than the simple name suggests.

A Chip Shortage Off The Old Block

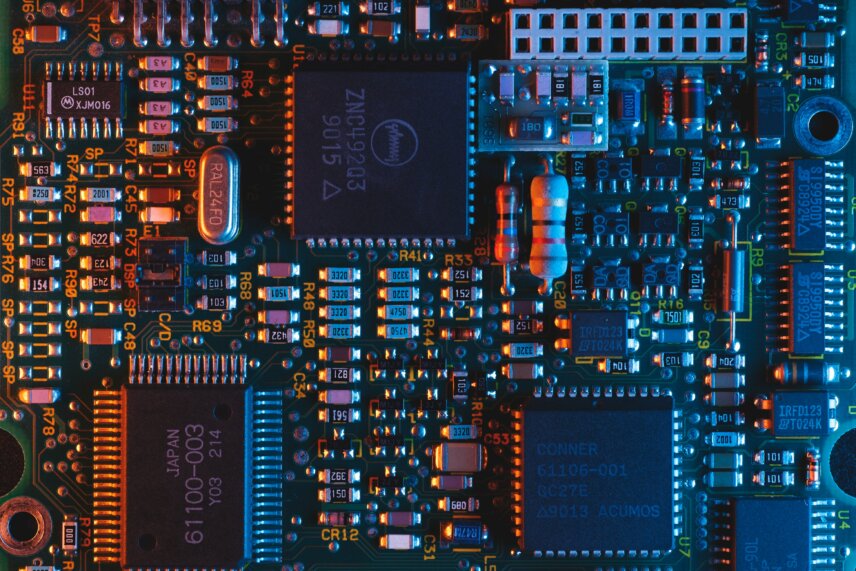

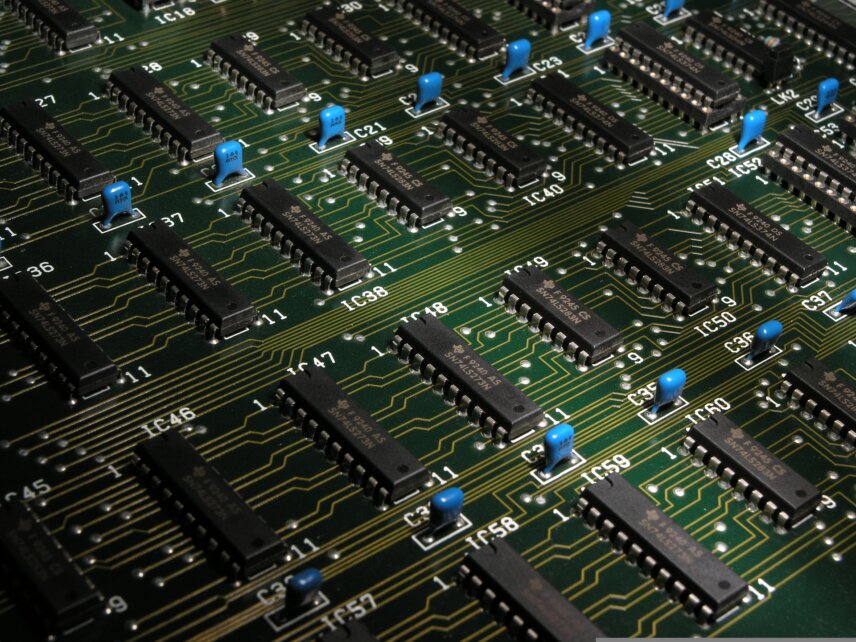

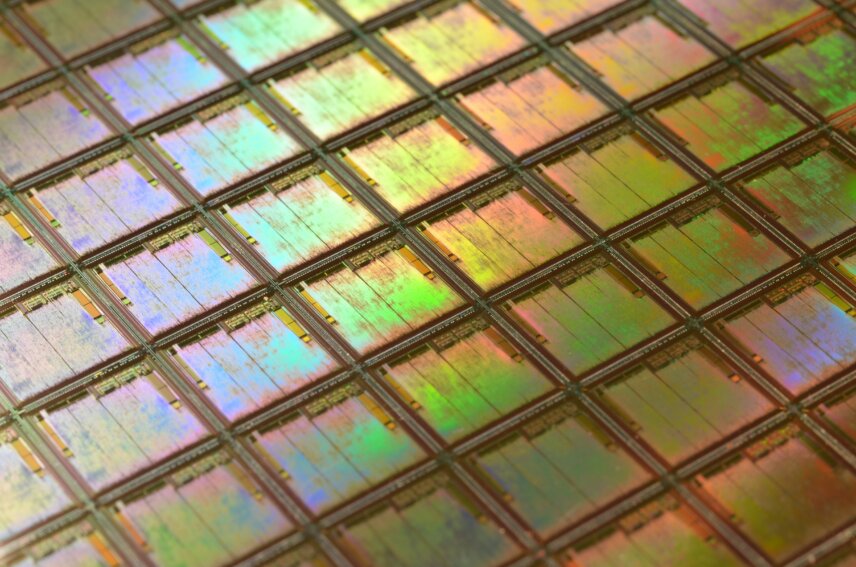

A chip, or microchip to use the full name, is essentially a complex electrical circuit imprinted onto a silicon wafer. This is why they are sometimes called integrated circuits, or IC chips. Before prefabricated microchips, electronics were made with discrete circuits or completely original designs. ICs simplified manufacturing by putting pre-designed circuits onto single chips that could be slotted into a PCB, or printed circuit board.

Cheap As Chips

Integrated circuits were a boon to electronic instrument manufacturing. They allowed for pattern recall, streamlined circuit design, and were also cheap. Compare the cost of synthesizers from the 1970s to those of the 1980s. Thanks to microchips (third-party or in-house), companies could release cheaper products with more features. It was a win-win, with both manufacturers and musicians benefitting.

These days, chips are in everything, from synthesizers and drum machines to cars and smartphones. Thanks to IoT (the internet of things), televisions, microwaves and other home appliances are getting them. You even have one on your credit card. They’re everywhere.

And that’s the problem.

Let The Chips Fall Where They May

The semiconductor industry, of which microchips are a part, was thrown into confusion in early 2020 by COVID-19, with the outbreak and ensuing global pandemic causing multifaceted and far-reaching problems. It’s an incredibly complex issue, one that highlights just how interconnected the world has become.

In early 2020, the world shut down in an effort to contain the spread of the new disease. Businesses and manufacturing plants closed, including those involved with making chips. The world’s population hunkered down in their homes, intent on riding out the storm. And then something happened: people started buying stuff online. With nothing else to do, people shopped. Sales of musical instruments took off, with musicians and hobbyists realizing that they finally had some free time to devote to their passion. The demand was unprecedented – and completely unexpected.

The microchip industry is tightly controlled, with just-in-time ordering ensuring no backlog of stock. Compounding the problem was the shutdown. With workers stuck at home, there was no one to work the factory lines to generate chips to meet all that sudden demand.

This issue is not over. Although it’s now late 2022, two and half years since the world first closed up shop, lockdowns are still affecting production. China has continued with a zero-COVID policy, with plants hitting the off switch every time a new outbreak sends everyone back inside their homes. The country has also cut its coal usage in an effort to reduce carbon emissions, rationing out electricity. Even if workers are at the factories, they might not have any electricity to run them. A fierce winter freeze in Texas and a fire at a Japanese plant have only further exacerbated the global issue.

When The Chips Are Down

The shortage is more than just microchip fabrication facilities running behind schedule. The materials that are needed for actual manufacturing are becoming scarce. Neon, which is a key ingredient in the chip manufacturing process, is itself in short supply, as half of the world’s neon comes from Ukraine, which is currently busy trying to repel an invading force. Behringer posted about this issue on its Facebook page in March, saying, “The chip shortage has just become much worse. 50% of the global production of neon gas required for all chip production comes from Ukrainian factories, which have now shut down. But rather than complaining about delivery dates for products, shouldn’t we all take a step back and focus our thoughts and prayers on the Ukrainian people?”

Along with neon, other key components in the manufacturing process are in short supply, such as the lead frames used to house the chip. According to Graham Scott, the Vice President of Global Procurement at Jabil, a global manufacturing company, “In Southeast Asia, COVID-19 outbreaks have impacted the supply of lead frames and assembly and testing. Suppliers have been forced to temporarily shut down facilities to curb the spread of the virus, further cutting overall semiconductor capacity and output.” Even the silicon used in the chips is getting rare, with a slowdown in silicon production to blame.

The problem, however, is more than just a shortage. Backlogs and long lead times are the norm, with the price of chips climbing ever higher. “Across the board, chip suppliers have raised prices between 5% and 15% in response to supply constraints and the increased shortages and costs of raw materials,” said Scott. “For older analog and diode technologies, price hikes have reached 20% to 25%.”

Some are starting to feel that the shortage might be managed or even completely manufactured. A semiconductor industry insider that we spoke to on the condition of anonymity told us that the major choke point in the chain is in the final packaging and testing stages, which often happens at third-party locations. “Workforce and materials shortages are a major factor in the US,” he explained. “However that’s not really causing many issues with the manufacturing of ICs due to the vast majority of package assembly and final test taking place in Asia. There is a lot of feeling that the Asian subcontractors … are stockpiling to keep the prices high, drip-feeding the markets with components in the process. We definitely see this with some of the top suppliers of materials where they shut facilities at the start of the pandemic but are currently refusing to restart them, preferring instead to use the limited supply, coupled with the surge in demand, to artificially keep prices higher. In 28 years I’ve not seen anything like it and the semi industry is planned like no other. Very few surprises happen!”

On The Edge

All of this (not to mention ongoing woes in the shipping industry) have added up to release delays across the board for synthesizers and drum machines. One of the most visible examples is Behringer. Unlike other companies, which keep their product cards close to their chest until the announcement, Behringer is more open, posting about its development and manufacturing process on social media.

In the past few years, the company has announced an entire store’s worth of new products in development, with very few having actually made it to market. Just last August, it looked like the company’s analog drum machine Edge would finally be available for purchase, with a pre-order listing appearing on Thomann, but it was quickly removed. The company reportedly has a number of new and long-promised instruments ready to go, it just needs the chips.

It’s not just Behringer, either. Isla Instruments, makers of the S2400 sampling drum machine, recently announced on their Facebook page that they could finally start production on the instrument again after waiting two years for STM32H7 microcontroller chips. Haken Audio has had to put its EagenMatrix units on hold due to a lack of DSP chips. “EaganMatrix modules are a problem until I can get the DSP chips,” said Lippold Haken on Synthtopia.com. “Those DSP chips have been on order for over two years, and are now promised in September, but we will see.”

Expensive As Chips

With the cost of chips going up, it’s no surprise that instrument prices are going up as well. This past summer, Moog revealed that it was raising the prices of some of its instruments, and not insignificantly. The Matriarch went up $200 to $2200, the One up $1000 to $8999, and the Subsequent 37 up a whopping $400 to $1899. Moog defended its price changes, naming “the ongoing global challenges of material shortages” specifically. Haken will also reportedly have to raise the price on future batches of its ContinuumMini synthesizers.

A Bad Thyme

The chip shortage is having repercussions more serious than just delays and price hikes though. It’s adversely affecting businesses. Polish company Bastl Instruments has had to discontinue its Thyme delay unit because of the chip shortage. “It was the (32-bit) ARM processors,” Bastl CTO Vaclav Pelousek told us, “but also codec (digital to analog) converters that were not available. Also, the codecs were discontinued, which is what happens with the lower-demand niche components we depend on.” When asked if any of their other products have been affected, he answered, “Mostly it reshuffled our pipeline of unreleased products and (we) put some of them on hold, rendering the investment and effort buried.”

They’ve also been impacted by large tech companies placing huge orders for chips, depriving smaller companies. “This has been true mostly for ARM processors. The distributors, on the other hand, were putting smaller quantities of a lot of the chips up every day, basically trying to prevent stockpilers/speculators from getting hold of bigger quantities. This we saw as healthy but also it increased our workload because we had to check daily for what we could get.” Moving forward, the company plans to keep a diversified product line that doesn’t overly rely on any single type of chip. They’re also currently trying to redesign some of their products, particularly when it comes to the ARM processors.

“It is not only about the products that you have and cannot make,” Pelousek stressed, “it is also about the products you are developing and cannot move on … because of that. It is not just production, but R&D being affected as well, (with) increasing development times and wasting some development.”

Chipping Away

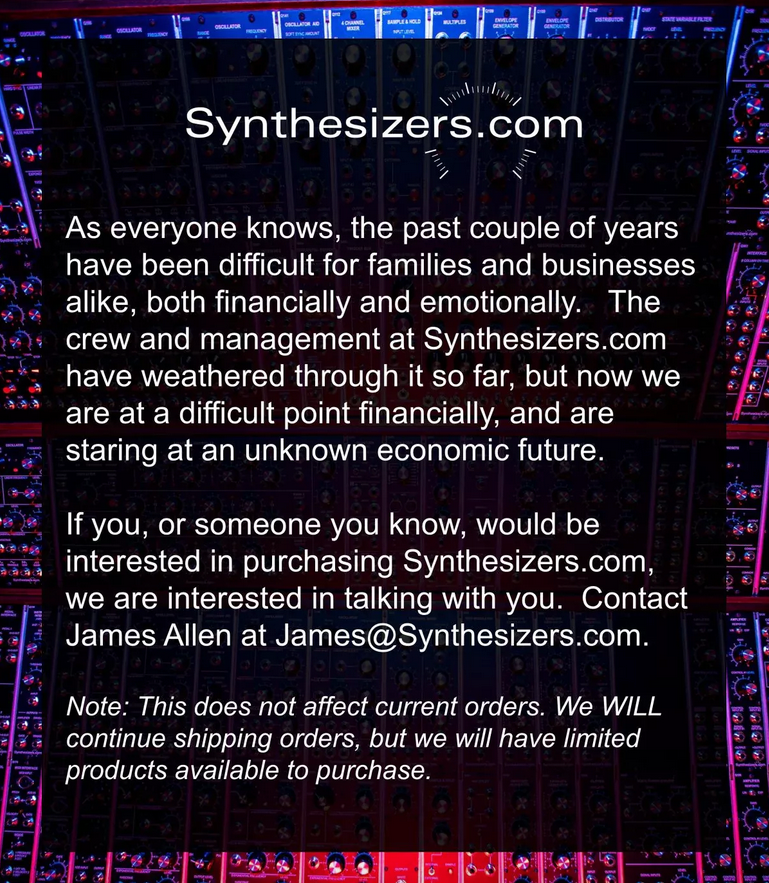

Not every business has been able to weather the storm like Bastl. Futureretro has closed up shop altogether, announcing on its now-closed website, “Due to the current state of the world and global parts shortages, we are forced to close our doors.” Synthesizers.com, the modular company that elevated the MU format, is now available for purchase.

In an announcement, the company stated, “As everyone knows, the past couple of years have been difficult for families and businesses alike, both financially and emotionally. The crew and management at Synthesizers.com have weathered through it so far, but now we are at a difficult point financially, and are staring at an unknown future.” Canadian modular outfit Hexinverter Électronique has also fallen victim to the economic disruptions of the chip shortage. After releasing the final batches of its modules, it will say goodbye in 2023.

Cash In Your Chips

Despite the long dark night, a brighter dawn may be coming. “The feeling is (the shortage) will start to ease in the third or fourth quarter of 2023 and into 2024 when the current demand surge drops off,” said our insider. Additionally, the microchip industry has identified the bottlenecks, with countries like America taking steps to bring manufacturing back after off-shoring so much of it, with Intel planning to create two giant new manufacturing plants in Columbus, Ohio. Additionally, government acts in the US and Europe are underway to help the industry. Taiwan also plans to increase its capacity.

In the meantime, hardware release delays and price increases will likely continue. However, as with other aspects of the COVID pandemic, things will hopefully soon be back to a semblance of normality.